The economics of home buying are getting interesting, thanks to higher mortgage rates, tax changes and a supply-demand imbalance.

The economics of home buying are getting interesting, thanks to higher mortgage rates, tax changes and a supply-demand imbalance.

This spring’s home sales season is shaping up to be the most interesting one in years.

The housing market will depend on which opposing force proves more powerful: long-term fundamentals of supply and demand, or near-term ripples emanating from Washington and Wall Street.

Most evidence suggests that fundamentals will prevail over time and push sales and prices higher, especially at the lower and middle tiers of the market. But the opposing forces could mean a period of uncertain deal-making. Higher mortgage rates and a new tax law will affect several elements of home buying.

Mortgage Rates Are Higher

This is the simplest to calculate. In mid-September, according to Freddie Mac, the average rate on a 30-year, fixed-rate mortgage was 3.78 percent; in the most recent reading it hit 4.45 percent. It rose because global bond markets, which ultimately determine the rates on longer-term loans, judged that larger budget deficits and a faster-growing economy would result in higher inflation and more interest rate increases from the Federal Reserve.

For a family resolving to pay $2,000 a month for a home mortgage and not a penny more, the math works out that they can afford to borrow $397,000 today, down from $430,000 in September.

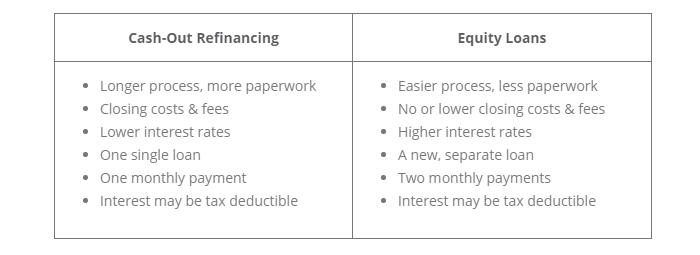

The math around affordability is a little more complicated than that — you must also consider the potential tax deductibility of mortgage interest and how much cash a buyer has available for a down payment.

The psychology around a rise in rates isn’t necessarily straightforward either. A survey for the online brokerage Redfin — involving 4,000 people who bought or sold a home last year or tried to do so — found that 25 percent of respondents said a mortgage rate rise to 5 percent would have “no impact” on their home-buying plans.

Twenty-one percent said they would search with more urgency, fearing that prices would rise faster, while 27 percent said they would slow their search and wait to see if rates came back down. Only 21 percent said they would seek to buy a less expensive house.

“If shortage of inventory is a headwind for housing, mortgage rates are a gentle breeze by comparison,” said Nela Richardson, chief economist at Redfin.

The Tax Law Is Messy

The United States tax code subsidizes homeownership in ways large and small. (Whether those subsidies encourage greater homeownership or just drive up prices is a different matter.) But the tax law enacted in December reins in several of those advantages.

Most directly, the law reduces how much mortgage debt will benefit from tax-deductible interest payments; that number was previously $1 million and is now $750,000. Also, property taxes previously had no limits in being deductible against federal income tax, but now the deduction of property and other state and local taxes is capped at $10,000.

Both provisions will most affect upper- and upper-middle-income families in states with relatively high housing prices and high state and local taxes: Think Massachusetts, Connecticut, New York, New Jersey, Maryland and California.

For example, a married couple in Connecticut with a $300,000 annual income aiming to borrow $1 million toward a $1.2 million house would be able to deduct about $33,000 in mortgage interest in the first year of their loan, compared with about $44,000 under the previous law. Because they would be in the 24 percent federal marginal tax bracket, buying that house would cost them about $2,650 more in the first year of the mortgage after taxes than under previous law.

Moreover, that family’s state income tax obligations would push them over the $10,000 deductibility limit on their own, meaning the family would effectively lose the ability to deduct property taxes of around $22,000 a year, depending on the jurisdiction. That represents another reduction of this family’s tax advantage from homeownership by about $5,000 a year.

(Our hypothetical family may not be losing out as much as those numbers suggest because they would have faced the alternative minimum tax under the old tax system — evidence of just how complex these calculations can be.)

Even people whose mortgages are well below $750,000, or who are in lower-tax states, may find the tax law could shift the incentives for buying compared with renting. The new law roughly doubles the standard deduction that all households can take, to $24,000 for a married couple, which means that more households will find that they get no net tax savings from taking on a mortgage. They are better off just taking the larger standard deduction whether they buy or rent.

Over all, Moody’s Analytics estimates that the tax law will reduce home transaction prices by 4 percent, a number that reflects both the direct impact of tax changes and higher interest rates caused by larger deficits.

But Mark Zandi, the company’s chief economist, emphasizes that this reduction should play out over a couple of years, and that it is more likely to slow the rate of price gains rather than cut prices outright. For example, if prices were on track to rise 5 percent a year in 2018 and 2019, they might instead rise 3 percent a year.

“The tax law change and higher mortgage rates should moderate the prices buyers are able to pay,” Mr. Zandi said. “I think the rate of house price growth will soften.”

Supply and Demand Are Mismatched

Those developments on interest rates and tax policy seem likely to be drags on home buying. But they come amid a housing boom rooted in a major imbalance between the number of people looking to buy, especially in cities with strong job growth, and the inventory available.

On the demand side, the peak year for births in the millennial generation was 1990, meaning they are turning 28 this year. Many members of that large generation are now in their 30s, marrying and having children.

In their 20s, this group was forming new households at lower rates than earlier generations because of a scarcity of jobs in the aftermath of the financial crisis, large student debts and perhaps a cultural shift in attitudes toward homeownership. That appears to be changing as they get older.

But the rising demand has not been accompanied by increase in supply.

Builders started work on 1.3 million new housing units in 2017, which is up a lot from the depressed levels of the 2008 recession but still below the 1.5 million average between 1959 and 2007.

There was overbuilding relative to demographic trends in the mid-2000s housing boom, but the opposite has been true for a while.

The home-building industry attributes this to the constraints it faces.

Many of the metropolitan areas with the strongest rates of job creation — and hence housing demand — have restrictive zoning laws that make finding suitable land a challenge. The housing bust drove some construction firms out of business and their workers out of the industry, meaning a shortage of building capacity years later. Tighter immigration enforcement has limited labor supply in some markets, and prices of many building materials have risen faster than overall inflation.

“Longer-term demographics are telling us that every year there are going to be more people entering the stage of life where they want to get married, have kids and buy a home, and they’re going to be looking for housing to accommodate that stage of life,” said Skylar Olsen, a senior economist at Zillow. “The fundamentals are pushing up against the reality of so much pent-up demand.”

In other words, as long as there are more families looking for a place to live than new homes in place to accommodate them, the pressure on prices and sales will be upward, no matter what happens as the market adjusts to higher mortgage rates and tax changes.

For more information on home mortgages, contact Prime Lending at the McMullen Group.

nytimes.com

Tax changes don’t seem to have changed the calculus on home ownership very much

Tax changes don’t seem to have changed the calculus on home ownership very much

Those who opt for a

Those who opt for a  Every day, first responders do the unthinkable. They put themselves in harm’s way as they respond to emergencies and natural disasters, making rescues, providing medical care, securing crime scenes, extinguishing fires and much more.

Every day, first responders do the unthinkable. They put themselves in harm’s way as they respond to emergencies and natural disasters, making rescues, providing medical care, securing crime scenes, extinguishing fires and much more.

Getting preapproved for a mortgage

Getting preapproved for a mortgage First-time home-buyers nationwide are deciding whether to rent or own. The perceived challenges to

First-time home-buyers nationwide are deciding whether to rent or own. The perceived challenges to  Buying a home

Buying a home Spring is traditionally the busiest season for real estate sales, but this year, buying season began in January. Inventory is selling fast — at record rates, according to the February 2018 RE/MAX National Housing Report — which also means a shortage in housing, especially for first-time buyers. The economy is stable and employment rates are low, which means spring 2018 will be an active one in the housing market.

Spring is traditionally the busiest season for real estate sales, but this year, buying season began in January. Inventory is selling fast — at record rates, according to the February 2018 RE/MAX National Housing Report — which also means a shortage in housing, especially for first-time buyers. The economy is stable and employment rates are low, which means spring 2018 will be an active one in the housing market. The kitchen is the heart of your home. It’s where you prepare meals and gather with loved ones. It’s the entertainment hub. It may be the spot where you sit to sip your morning coffee or where you kiss your kids goodbye before sending them off to the bus for school.

The kitchen is the heart of your home. It’s where you prepare meals and gather with loved ones. It’s the entertainment hub. It may be the spot where you sit to sip your morning coffee or where you kiss your kids goodbye before sending them off to the bus for school. Saving for a down payment often represents the biggest hurdle for first-time home buyers. In December, 25% of buyers on realtor.com® who were looking to purchase their first home said a key factor holding them back was lacking funds for a down payment. No matter how you cut it, it represents a big chunk of cash. But here's the thing: It doesn't always need to be quite so big as most think.

Saving for a down payment often represents the biggest hurdle for first-time home buyers. In December, 25% of buyers on realtor.com® who were looking to purchase their first home said a key factor holding them back was lacking funds for a down payment. No matter how you cut it, it represents a big chunk of cash. But here's the thing: It doesn't always need to be quite so big as most think.

When it comes to

When it comes to  If you’re planning on creating and customizing your dream home, there are several benefits of

If you’re planning on creating and customizing your dream home, there are several benefits of  Buying a home is likely the biggest purchase you’ll make in your lifetime, and one that can seem overwhelming. If you’re considering purchasing a home in the not-too-distant future, now’s the time to start saving.

Buying a home is likely the biggest purchase you’ll make in your lifetime, and one that can seem overwhelming. If you’re considering purchasing a home in the not-too-distant future, now’s the time to start saving. When it comes to mortgages, there's a big gap between what people think they need in order to get one and the reality of what buyers are successfully doing—especially young people.

When it comes to mortgages, there's a big gap between what people think they need in order to get one and the reality of what buyers are successfully doing—especially young people.

Mortgage payment

Mortgage payment Who qualifies as a hero?

Who qualifies as a hero? Serving others is the most humble and noble career any of us can decide to take on. Many of us work in some form of service – but a select few serve with a level of sacrifice attached to it. These are our heroes. If you are reading this, you are likely one of these heroes or are closely related to one. For this, we cannot possibly thank you enough.

Serving others is the most humble and noble career any of us can decide to take on. Many of us work in some form of service – but a select few serve with a level of sacrifice attached to it. These are our heroes. If you are reading this, you are likely one of these heroes or are closely related to one. For this, we cannot possibly thank you enough. For many home buyers, private mortgage insurance is a necessary evil. If you don’t have 20% in cash to put down on a home, you’ll often be left with little choice other than PMI.

For many home buyers, private mortgage insurance is a necessary evil. If you don’t have 20% in cash to put down on a home, you’ll often be left with little choice other than PMI. You found a home. You’re ready to make an offer. But what’s that strange gnawing feeling that you can’t shake? Pay attention! It could be that your own five senses are warning you that this house just doesn’t make sense.

You found a home. You’re ready to make an offer. But what’s that strange gnawing feeling that you can’t shake? Pay attention! It could be that your own five senses are warning you that this house just doesn’t make sense.  Many people dream of having a

Many people dream of having a

That home renovation project you’ve been considering might look great on Houzz, but is it worth the investment? When it comes to home improvement, “Will this help my house’s resale value?” may be the most critical question you need to ask yourself before heading to the hardware store or hiring a contractor. If you anticipate selling your home in the near future, here’s a list of renovation projects that can boost home value to potential buyers:

That home renovation project you’ve been considering might look great on Houzz, but is it worth the investment? When it comes to home improvement, “Will this help my house’s resale value?” may be the most critical question you need to ask yourself before heading to the hardware store or hiring a contractor. If you anticipate selling your home in the near future, here’s a list of renovation projects that can boost home value to potential buyers: The McMullen Group has a combined experience of over 30 years in the mortgage industry. We offer a wide range of home financing options designed to take advantage of today’s real estate market. Our team takes the time to ask all the necessary questions up front to determine the best available loan program to fit your specific needs. We’re invested in our client’s success and it is important to work with true professionals to help guide you through the loan process. Whether you are purchasing a home or refinancing an existing home, we are with you every step of the way.

The McMullen Group has a combined experience of over 30 years in the mortgage industry. We offer a wide range of home financing options designed to take advantage of today’s real estate market. Our team takes the time to ask all the necessary questions up front to determine the best available loan program to fit your specific needs. We’re invested in our client’s success and it is important to work with true professionals to help guide you through the loan process. Whether you are purchasing a home or refinancing an existing home, we are with you every step of the way.